When I teach introductory classes on monetary economics, I follow Fernando Nechio's simplified version of the Taylor Rule:

Target rate = 1 + 1.5 x Inflation – 1 x Unemployment gap.

It is easy to remember and provides a decent back of the envelope. I've been looking for a decent online applet, and came across a script from Don't Quit Your Day Job. It nicely integrates with current data, allows you to adjust the coefficients, and shows everything on a chart (recent monetary difficulties are clearly expressed by the fact that the Taylor rule never drops below zero).

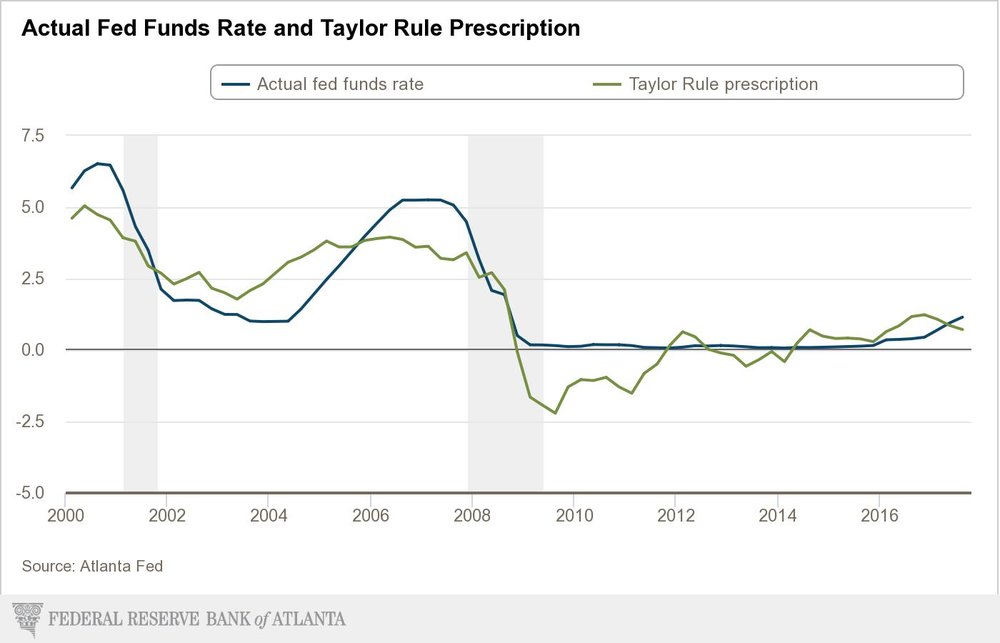

A recent WSJ article by Michael Derby (h/t Mike Bird) uses a tool from the Atlanta Fed to claim that rates for the US should now be 2.5% - 3% under a Taylor Rule. A very nice aspect of this is the ability to tweak the estimate of the natural rate (conventionally, but arbitrarily, set to 2%). Using a Laubach-Williams model this reduces the Taylor rule to just 0.72%, which is below the current Fed Funds target (see chart).

The classic version of the Taylor Rule (the one I use in my textbook) is as follows:

i=r+PT +a(P−PT)+b(Y−Y∗)

Using that, a current estimate for the UK is 4%:

You can download the spreadsheet here.